Cit Bank Fee Schedule: Navigating the world of banking fees can feel like trekking through a jungle of confusing terms and hidden costs. But fear not, intrepid explorer! This guide cuts through the undergrowth, revealing the secrets of Cit Bank’s fee structure in a way that’s both clear and, dare I say, exciting. We’ll uncover the hidden pathways to understanding exactly what you’re paying for and how to potentially minimize those charges.

Get ready for a thrilling financial adventure!

Source: listenmoneymatters.com

We’ll dissect each fee, from the seemingly insignificant to the potentially hefty charges, providing you with the knowledge to make informed decisions about your banking relationship with Cit Bank. Think of this as your survival manual for the wild world of banking fees – armed with this information, you’ll be able to navigate the financial landscape with confidence and a smile.

Understanding the fee structure of any bank is crucial for effective financial management. This comprehensive guide provides a detailed overview of CIT Bank’s fee schedule, covering various account types and services. We’ll explore common fees, potential waivers, and strategies to minimize costs. This information is intended for educational purposes and should not be considered financial advice. Always refer to CIT Bank’s official website for the most up-to-date information.

Understanding CIT Bank’s fee schedule is crucial before application, as these charges can significantly impact the overall cost of services. This is particularly relevant given that a denial of application, as detailed in this account of a rejected application cit bank denied my application , may necessitate a reevaluation of banking options and associated fee structures. Therefore, a thorough review of the CIT Bank fee schedule remains a prudent step in financial planning.

CIT Bank Account Types and Associated Fees: Cit Bank Fee Schedule

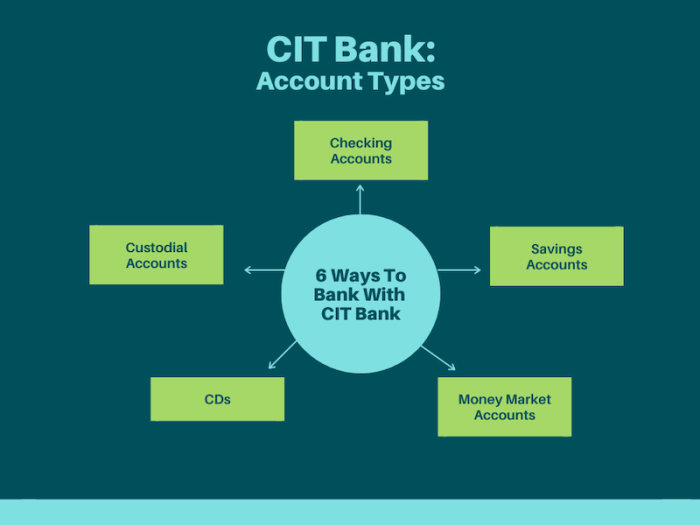

CIT Bank offers a range of banking products, each with its own fee structure. These include:

High-Yield Savings Accounts

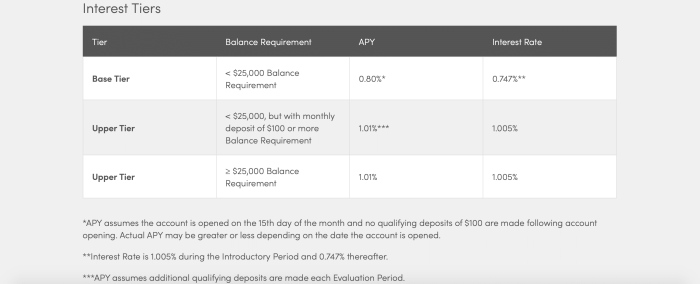

CIT Bank’s High-Yield Savings Accounts are known for their competitive interest rates. However, it’s important to understand any associated fees. Generally, these accounts do not have monthly maintenance fees, but exceeding a specific number of transactions per month might incur charges. Always check the current terms and conditions for the most accurate information.

- Monthly Maintenance Fee: Typically waived.

- Transaction Fees: May apply for exceeding a certain number of transactions. Check the account agreement for specifics.

- Overdraft Fees: These fees apply if you withdraw more money than is available in your account. The specific amount varies and is Artikeld in the account agreement.

- Wire Transfer Fees: Fees apply for sending or receiving wire transfers. These fees can vary depending on the amount and destination.

Checking Accounts, Cit bank fee schedule

CIT Bank’s checking accounts may or may not have monthly maintenance fees depending on the specific account type and whether you meet certain requirements (e.g., minimum balance). Transaction fees are less common but can still exist for specific actions like excessive over-the-counter transactions.

- Monthly Maintenance Fee: May apply; conditions for waivers often involve maintaining a minimum balance.

- Transaction Fees: Potentially applicable for exceeding a specified number of transactions or for specific transaction types.

- Overdraft Fees: Charged if you overdraw your account. The amount varies and is stated in the account agreement.

- Stop Payment Fees: Fees for requesting a stop payment on a check.

Money Market Accounts

Similar to savings accounts, money market accounts often offer higher interest rates than traditional savings accounts. However, they may have more stringent requirements and potentially higher fees.

- Monthly Maintenance Fee: May apply; conditions for waivers are often linked to minimum balance requirements.

- Transaction Fees: May apply for exceeding a specified number of transactions.

- Overdraft Fees: Apply if you withdraw more money than available in your account.

Certificates of Deposit (CDs)

CIT Bank offers CDs with varying terms and interest rates. Fees associated with CDs are generally less common than with other account types, but early withdrawal penalties can be substantial.

Source: financedevil.com

- Early Withdrawal Penalty: A significant penalty is applied if you withdraw funds before the CD’s maturity date.

Minimizing CIT Bank Fees

Several strategies can help you minimize or avoid CIT Bank fees:

- Maintain Minimum Balances: Many fees are waived if you maintain a minimum balance in your account. Carefully review the requirements for your specific account type.

- Limit Transactions: Excessive transactions can lead to fees. Plan your banking activities accordingly.

- Utilize Online and Mobile Banking: These options often avoid fees associated with in-person transactions.

- Review Account Agreements: Regularly review your account agreements to stay informed about any changes to the fee schedule.

- Consider Account Bundling: Bundling multiple accounts might offer fee waivers or discounts.

Frequently Asked Questions (FAQ)

- Q: What is CIT Bank’s overdraft fee? A: The specific amount of the overdraft fee varies and is clearly Artikeld in your account agreement. It’s advisable to check your agreement for the most accurate information.

- Q: Does CIT Bank charge monthly maintenance fees? A: This depends on the specific account type and whether you meet certain conditions, such as maintaining a minimum balance. Check your account agreement for details.

- Q: What are the fees for wire transfers? A: Wire transfer fees vary based on the amount and destination. Contact CIT Bank directly for the most current pricing.

- Q: Are there any fees associated with opening a CIT Bank account? A: Generally, there are no fees associated with opening an account, but it’s always best to verify this on their official website or by contacting customer service.

- Q: How can I avoid fees with my CIT Bank account? A: Maintaining minimum balance requirements, limiting transactions, and utilizing online banking are key strategies to minimize fees.

Disclaimer

This information is for educational purposes only and should not be considered financial advice. Always refer to CIT Bank’s official website and account agreements for the most up-to-date and accurate fee information. Contact CIT Bank directly if you have specific questions about their fee schedule.

Call to Action (CTA)

Visit the official CIT Bank website today to review their current fee schedule and learn more about their various banking products. Understanding your bank’s fees is a critical step in managing your finances effectively.

Source: retirementinvestments.com

Sources:

While specific fee schedules are not consistently published on a single page, the following resource is helpful for general information and locating relevant account agreements:

Note: Always check the official CIT Bank website for the most up-to-date fee information as policies can change.

So there you have it – a clearer picture of the Cit Bank fee schedule. While banking fees might seem like a necessary evil, understanding them empowers you to make choices that best suit your financial needs. Remember, knowledge is power, and in the world of personal finance, that power translates directly to saving money. Now go forth and conquer your banking fees! You’ve got this.