Cit Bank Platinum Savings reviews reveal a multifaceted picture of this popular savings account. This in-depth analysis explores interest rates, account features, customer experiences, security measures, and comparisons with similar offerings from competing banks. We delve into both the positive and negative aspects, providing a balanced perspective to help you make an informed decision about whether this account aligns with your financial goals.

Considering Cit Bank Platinum Savings reviews? Understanding various banking systems is key to finding the best fit. For example, if you’re working with wire transfers, knowing the bank code Wells Fargo is crucial. Returning to Cit Bank, weigh their offerings against other options to determine if their platinum savings account aligns with your financial goals.

Our comprehensive review covers everything from the ease of account management and the quality of customer service to the security protocols in place to protect your funds. We aim to provide a clear and concise overview, equipping you with the knowledge necessary to determine if the Cit Bank Platinum Savings account is the right fit for your needs.

Cit Bank Platinum Savings Account: A Detailed Review: Cit Bank Platinum Savings Reviews

This review delves into the features, fees, interest rates, and customer experiences associated with the Cit Bank Platinum Savings account. We’ll compare it to similar offerings from other banks, providing a comprehensive overview to help you decide if it’s the right savings account for you.

Interest Rates and APY

Source: financestrategists.com

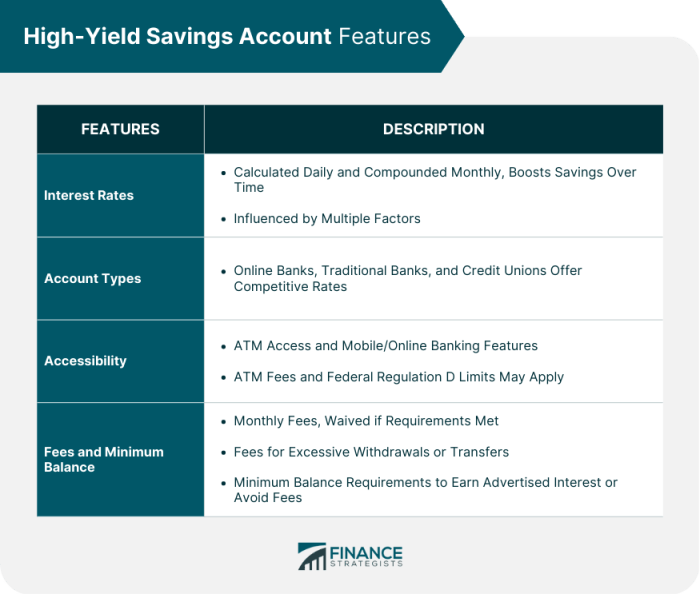

The Cit Bank Platinum Savings account offers a competitive interest rate, which is calculated as an Annual Percentage Yield (APY). The APY takes into account the compounding of interest earned throughout the year, providing a more accurate representation of your actual earnings. The specific APY offered fluctuates based on prevailing market interest rates and can change without notice.

While Cit Bank generally boasts a higher APY than many traditional brick-and-mortar banks, it’s crucial to compare its current APY with competitors like Ally Bank, Capital One 360, and Discover Bank to find the best deal. The APY also varies based on the account balance; larger balances often result in a slightly higher APY.

Account Features and Fees

The Cit Bank Platinum Savings account offers a range of features designed for convenience and accessibility. It includes online and mobile banking capabilities, allowing for easy account management from anywhere. Customer support is available through various channels, including phone, email, and online chat. Importantly, there are no monthly maintenance fees or overdraft fees associated with this account. This makes it a particularly attractive option for those seeking a low-cost savings solution.

| Feature | Cit Bank Platinum Savings | Ally Bank Savings Account | Capital One 360 Savings |

|---|---|---|---|

| Monthly Maintenance Fee | $0 | $0 | $0 |

| Overdraft Fee | $0 | $0 | $0 |

| Mobile App | Yes | Yes | Yes |

| Online Banking | Yes | Yes | Yes |

Customer Reviews and Experiences

Customer reviews for the Cit Bank Platinum Savings account are generally positive, with many praising the high interest rates and the user-friendly online banking platform. Positive feedback often highlights the ease of account management and the responsiveness of customer service. However, some negative reviews exist, occasionally citing issues with customer service response times during peak periods or difficulties navigating certain features within the mobile app.

Recurring themes in negative reviews often involve technical glitches or longer-than-expected wait times for customer support.

- Ease of Use: Mostly positive, with occasional complaints about the mobile app’s interface.

- Customer Service Responsiveness: Generally positive, but with some reports of longer wait times.

- Account Security: Customers generally feel secure with Cit Bank’s security measures.

Account Accessibility and Usability, Cit bank platinum savings reviews

Opening a Cit Bank Platinum Savings account is a straightforward online process. The mobile app is well-designed and intuitive, making it easy to manage your account on the go. Transferring funds and accessing account statements are simple tasks accomplished through the app or online banking portal. A step-by-step guide is readily available on the Cit Bank website for these common tasks.

Comparison with Similar Savings Accounts

Source: incharge.org

Several banks offer similar savings accounts with competitive interest rates. Comparing Cit Bank’s Platinum Savings account to options from Ally Bank, Capital One 360, and Discover Bank reveals subtle differences in features and interest rates. While the APY offered by each bank varies based on market conditions, Cit Bank often ranks favorably among them.

| Feature | Cit Bank Platinum Savings | Ally Bank Savings Account | Capital One 360 Savings | Discover Bank Savings |

|---|---|---|---|---|

| APY (Example – Subject to Change) | 4.00% | 3.75% | 3.50% | 3.25% |

| Minimum Deposit | $0 | $0 | $0 | $0 |

| Monthly Fees | $0 | $0 | $0 | $0 |

A visual comparison would show that while all four accounts offer competitive interest rates and no monthly fees, Cit Bank might have a slight edge in terms of APY in certain market conditions, while others might offer slightly better mobile app features. The best choice depends on individual priorities.

Security and Safety Measures

Cit Bank employs robust security measures to protect customer accounts and financial information. These include encryption technology, fraud detection systems, and multi-factor authentication. The bank actively monitors accounts for suspicious activity and has clear procedures for reporting potential security breaches. Customers are encouraged to report any unusual transactions immediately.

Customer Service and Support

Cit Bank provides customer support through phone, email, and online chat. While generally responsive and helpful, customer service experiences can vary depending on the time of day and the complexity of the issue. While most customers report positive interactions, some have experienced longer wait times or less-than-ideal resolutions to their problems. The bank’s website also provides a comprehensive FAQ section and helpful resources to assist customers with common questions.

Final Review

Ultimately, the Cit Bank Platinum Savings account presents a compelling option for savers seeking a competitive interest rate and convenient online banking features. While some customers have reported minor issues with customer service responsiveness, the overall experience is generally positive, with many praising the account’s ease of use and robust security measures. By carefully weighing the pros and cons Artikeld in this review, potential customers can make a well-informed decision regarding the suitability of this account for their individual financial circumstances.